How to Understand Underwriting Assumptions in Multifamily Real Estate Investments

Underwriting, underwriting, underwriting. You’ve heard the word 1,000 times since you started researching real estate investment opportunities.

So what is it? What does it mean? How does it happen? And what do you need to know as a passive investor?

This article answers all those questions and more.

The great part about being a passive investor is that opportunities to invest will be presented to you in a neat package for you to evaluate. Despite this, it’s important to understand what assumptions and information went into this package so you can ask the right questions and limit your risk. Before the deal reaches your desk, a syndicator has already completed an underwriting analysis that showcases the assumed profit you could receive as an investor. This analysis is packed with numbers, calculations, and terms that you need to know to make the most informed decisions possible.

Of course, there is no way of truly predicting the future or guaranteeing a certain outcome. Multifamily real estate syndications can take as long as ten years to complete, and we all know how much can change in a decade. It’s the syndicator’s job to do as much research and analysis as possible in order to prepare for these potential changes, underwrite conservatively and ensure an optimal outcome for all investors.

We suggest leaning towards deals that have been conservatively underwritten. This reduces potential risk and allows you to have a better chance of meeting or exceeding the expected profit.

Alternatively, aggressive underwriting can leave you disappointed if something goes wrong or there are changes to the market and promised returns are less than anticipated. When selecting a syndicator to work with, look for someone who underpromises and over-delivers rather than the contrary.

While there are countless inputs used in the underwriting process, this article will break down three of the most important terms used in underwriting multifamily real estate deals. These terms are:

Rent growth

Occupancy rates/economic vacancy

Exit cap rate

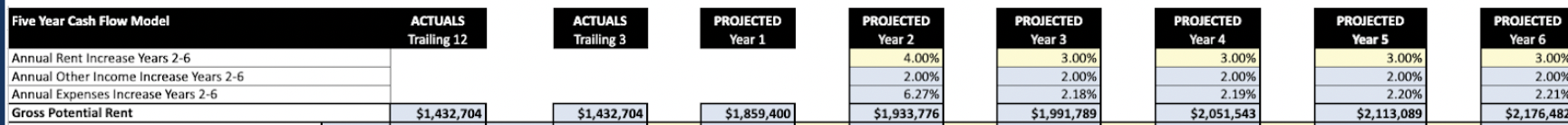

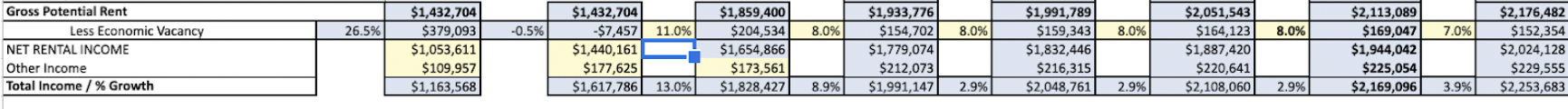

This is an example of a 5-year analysis you would see in an investor presentation. Don’t worry about all of the numbers for now. Just know we will use this example for reference throughout the article to help ground you in the concepts.

What is underwriting?

Underwriting is part of the due diligence process. Active investors, whether they’re purchasing a single-family home or a 30-unit apartment building, are responsible for completing the necessary due diligence on a potential project before making the decision to invest. On a multifamily syndication deal, the lead syndicator will complete a financial analysis to see if the deal makes sense.

The process involves a level of beginning with the end in mind.

The question at hand is, “what is the targeted return?” followed by, “what needs to be true for that to happen?”

From there, the syndicator works backward, using certain assumptions to decide if the deal at hand has the potential to support this goal. Either the numbers work, or they don’t. Syndicators who do not take a conservative approach when underwriting often find themselves in hot water when they begin to manipulate the assumptions to “make” the deal work.

Sure, in a perfect world, some of these manipulated assumptions could come true, such as organic rent growth increasing 10% year over year. Everyone would have a big payday and celebrate. But we don’t live in a perfect world. Things can change whether we like it or not. A well-underwritten deal takes all the possibilities into consideration and makes assumptions based on reality or even “worst case” scenarios so that even if the unexpected does occur, they’re still able to generate a profit.

As a passive investor, understanding these key components and how they factor into the bottom line will help you to properly vet your syndicator and each deal that comes your way. It will serve you, in the long run, to know how to read an underwriting analysis and know how it stands up against current and future market conditions. Each assumption made when underwriting can move the needle one way or another. For example, a change in the expected exit cap rate can have a dramatic impact on the returns, whereas a minimal change in expenses won’t affect the returns as much.

Part of evaluating how a deal has been underwritten comes down to understanding the current market conditions. If an analysis states that you will need a certain annual rent growth each year to achieve returns, it’s important to know if their number is conservative or aggressive based on the market.

For example, many of the properties we invest in are in Phoenix, which has seen double-digit year-over-year growth in rents over the past several years.Yet on the last deal we underwrote, we still only used 3% in our assumptions. If rent growth continues in the double digits, we all win. If rent growth takes a dip, though, we are still going to win and not completely miss our projections. This illustrates the importance of conservative underwriting.

Now, let’s dive into these key underwriting terms, what they mean, and what you need to know about them.

What is Rent growth and Gross Potential Rent?

It is important to note that the rent growth we are referring to in this section is not the same as what happens when you add value to a property and increase monthly rent prices. This rent growth refers to the organic growth that occurs according to the nature of the market. Rent growth comes into play when calculating projected gross potential rent (GPR) over a 5-year period. GPR is the amount of rental income that an owner can expect to collect during a specific period of time, assuming every unit is occupied and being rented at market value. This metric is found in the 5-year analysis sheet on the 4th line and is the starting point of an underwriting analysis to understand potential rental income from a property.

GPR is calculated by taking the current market rental rate and multiplying it by the number of units.

So, for example, if the current monthly market rent for a one-bedroom, one-bathroom unit in the same neighborhood and asset class as yours is $1,000 and the property has 100 units, the GPR would be $10,000 per month or $120,000 per year. That would be just for year 1, though. When underwriting, you will typically see a 5-year analysis done. That means you need to project an organic rental growth percentage each year for the next four years.

As we know, market conditions can change based on the overall shifts in the economy. That’s why it is important to make conservative assumptions here, ideally below what the last 5-year growth average has been. This is when using a conservative percentage, such as 3% vs. 10%, like we used in the example above, comes in.This protects you against market downturns or slowdowns and ensures that, even in the face of unforeseen changes, you can still expect to see returns.

What is Economic vacancy?

This is not to be confused with physical vacancy. Physical vacancy refers to the percentage of units in a building that are unoccupied. Economic vacancy is used to accurately estimate the actual potential rental income when taking into account the following factors.

As we’ve stated before, operators know that properties are never going to be 100% occupied and at market rent all the time. Economic vacancy takes into account the fact that market rents may not be achieved or that a percentage of units are not occupied throughout the year. Loss to lease, delinquencies, and vacancy are all factored into the economic vacancy percentage. “Loss to lease” is the amount of rental income being lost due to a unit being rented below market price.

The economic vacancy percentage calculation also takes into account the increase in rental prices that will come from adding value to the property if that is part of the business plan. These increases can offset some of the factors above that will pull down the potential rental income levels. Even with some level of increased rents due to improving units or the property, you will see economic vacancy expressed as a negative percentage in the 5-year analysis.

In the example above, take a look at the “Less Economic Vacancy” line item. You’ll notice that in year 1, it is projected at 11%, which means the syndicator is expecting an 11% loss of gross potential rent, which is why it is expressed as a negative number. If you multiply your economic vacancy percentage by the gross potential rent, you will get the total economic vacancy income loss. .

With economic vacancy loss taken into consideration, you can then calculate your net rental income, which is simply your gross potential rent less the economic vacancy loss.

From there, the remaining NOI calculations are fairly straightforward. You simply subtract operating expenses from the net rental income. NOI will help determine the sale price of the property, which is why it is so important to understand how factors such as rental growth and economic vacancy are estimated.

What is an Exit cap rate / reversion cap rate?

Known as “the gold standard” by commercial real estate investors, the capitalization rate or “cap rate” indicates the financial return that an asset will yield. The exit cap rate is used to estimate the resale value of a property when the holding period comes to an end.

Once the renovations are complete, rents have been raised, the business plan has been executed, and a higher NOI has been achieved, the syndicator will look to sell the property. That is where the exit cap rate comes into play.

This number is only important for equity investors who have a vested interest in the profitability of the asset. For preferred returns investors, the final sale of the building doesn’t carry any weight as it relates to their return on investment.

The exit cap rate is a key component in underwriting a multifamily investment syndication, as it has a large impact on the total return for passive investors. A syndicator is essentially using this number to predict the future sale price and assume the market value of the asset after several years.

Market cap rate is calculated based on recent transactions on other apartment buildings similar in size and age. In every market, there is a cap rate associated with the various types of assets, such as older Class C buildings or newer high rise Class A buildings. It is generally assumed that the market cap rate will compress (go down) over time as the price of real estate grows beyond the income that the property is generating. On the flip side of that coin, the cap rate can be expected to increase during a recession period.

When a syndicator underwrites a deal, they take a look at the current market cap rate and build in a conservative assumption about what it will be at the time of project completion. It is risky to assume that the exit cap rate will be lower than the entry cap rate. You want to be sure that the syndicator you’re choosing to invest with builds in a higher than current market cap rate; that way, even if the market conditions change for the worse, such as a recession, there is still a high likelihood of hitting the total targeted return.

When all is said and done, the syndicator will take the final projected annual NOI and divide it by the exit cap rate to get the assumed market value of the asset and, essentially the future sales price offer.

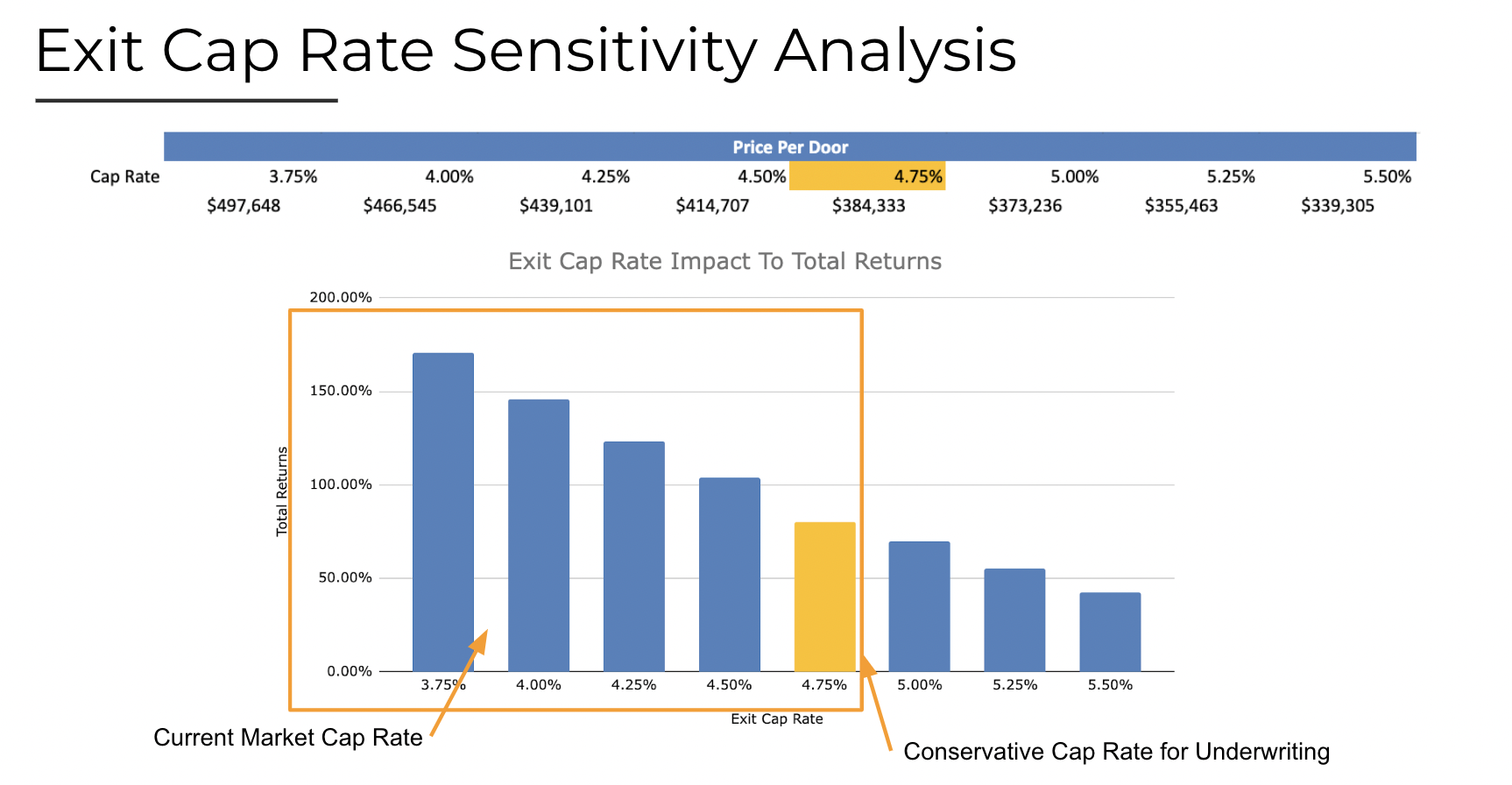

A small percentage change in the exit cap rate, such as 0.5%, can have a significant impact on the sales price and, therefore, the profits for equity investors. When reviewing a potential deal, you should be provided with an exit cap rate sensitivity analysis done by the syndication team. Below is an example of this type of analysis.

You can see that even the difference between an exit cap rate of 4.25% and 4.75% would have a significant impact on the sales price. If you assume this property has 100 units (also known as doors), then it’s the difference between a price of $5.5M ($43.9M at 4.25% vs $38.4M at 4.75%).

As mentioned above, there are many factors that go into the underwriting of a multifamily apartment syndication. These three main foundational elements used in underwriting are important for you to understand as a passive investor, as you will need this knowledge to vet potential deals that are presented to you. Use your own discretion when deciding how aggressive or conservative you’re comfortable being with your money, and always be willing to ask questions. Even as a passive investor, you still owe it to yourself and your hard-earned money to do your own level of due diligence.