What it Means to Go Full-Cycle in an Apartment Syndication

Every real estate investment deal has its own lifecycle. While there are variations from project to project, the general processes follow the same basic formula. You acquire a property, add value to the asset, then eventually sell or refinance. When you choose to get involved as a passive investor, you may not be as involved in the day-to-day operations. However, it is still important to understand the process from both the general partners' perspective as well as your own.

As you begin to explore the exciting possibilities available to you in the investment world, you will come across what may seem like an endless list of terminology. Along the way, it’s likely that you have heard the term “full cycle” as it relates to a multifamily syndication project. This article will dive into what the term means and everything you need to know about going “full cycle” as a passive investor in an apartment deal.

Full cycle is a noteworthy milestone for investors. It means that they’ve successfully taken a real estate deal from the starting point to the finish line. They’ve reached their investment goals, sold the property, and are ready to repeat the process. This can take anywhere from 2 to 7 years in a typical multifamily syndication so it’s a labor of patience to complete a full cycle project.

Before we dive into what a full-cycle deal looks like as a passive investor, allow us to review the life cycle of a multifamily apartment syndication from our perspective as the general partner (or active investor).

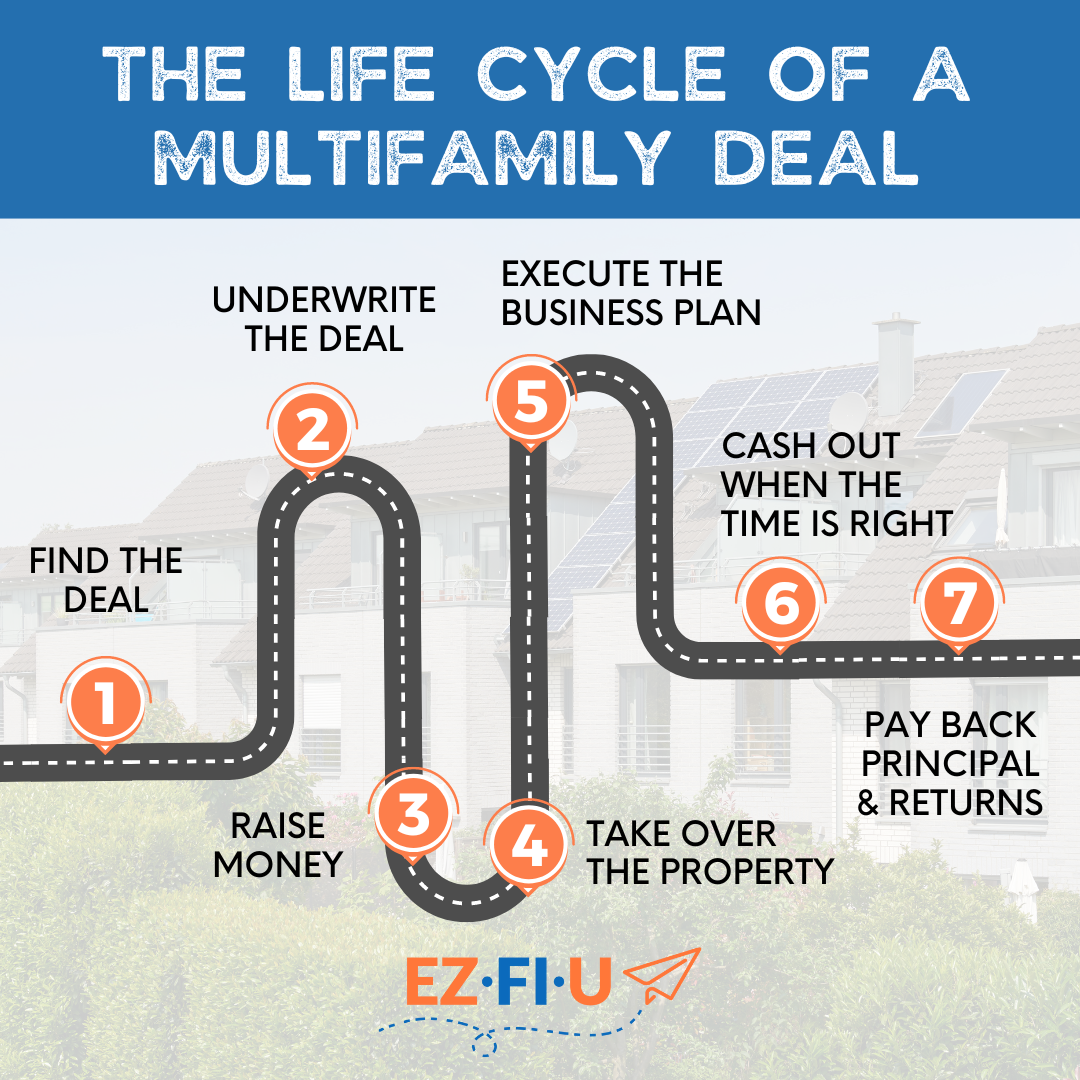

The Life Cycle of a Multifamily Deal

To fully understand the life cycle of a deal from the passive investor's standpoint, it’s helpful to see it from a bird’s eye view.

From start to finish, a syndication follows these 7 steps:

#1: Find the deal

General partners work with their real estate brokers to hunt for deals, both on and off the market. They carefully scout available properties that meet the criteria associated with their investment goals and expertise.

#2: Underwrite the deal

Once a potential property is located, someone on the general partner side then underwrites the deal to decide if it can be profitable given certain assumptions and if it fits within their investing criteria. Assuming it does, they move forward with putting in an offer and getting the property under contract.

#3: Raise money

This is where you, the passive investor, come in! With the project under contract, it’s time to raise the funds. The general partner begins to market the deal to potential investors. Collectively, they pool the money together to close on the deal. It is not uncommon to need the help of a lender during this time as well to provide additional funding in the form of loans.

#4: Take over the property

The next 6 months to 1 year are spent taking over the asset, including hiring new staff, transferring the financial documents, managing lease operations, building vendor relationships, creating renovation budgets, and looking for opportunities to lower expenses.

The goal during this period is to create a sense of stability where the project’s financials are in a healthy place, apartments are filled, and there is a manageable business plan ready to be executed.

#5: Execute the business plan

With a stable asset in place, it’s time to execute the business plan. This varies from property to property, depending on the type of syndication. Multifamily apartment syndications can range from ground-up construction to simply buying the property with intentions to keep it as-is.

Many properties undergo a value-add period where the syndication team makes a significant amount of updates that add value to the units and common areas. This can include upgrading units by putting in new flooring, washers/dryers, or adding amenities like a gym to the property in an effort to force appreciation (aka increase the value of the property) and create a higher return on investment at the end of the cycle.

#6: Cash out when the time is right

Once the intended profits have been generated, the syndicator will evaluate the appropriate time to sell or refinance the building according to the current market and business plan.

#7: Pay back principal and returns

Upon sale of the property, the lead syndicator will collect the profits, pay off the loan and fees, then distribute the appropriate portion of the profits plus their principal investment to all limited and general partners.

What to expect as a passive investor

So, what does all this mean for you as a passive investor?

Let’s go through the timeline again from the limited partner perspective. We will begin from the point at which you’ve already invested your money into the deal. The money is wired over to the syndicator, and now you’re officially a limited partner on the deal.

Takeover phase

It’s important to know that during the takeover phase, it is not likely that you will receive payouts. As the syndicator works to establish the stability of the project, however, you should receive regular communications and updates.

Unlike other investments, such as the stock market, where you can check online for daily updates, correspondences about your multifamily investment will be sent out either monthly or quarterly, depending on your agreement with the syndicator. That said, it is always important that you choose to work with a syndicator that you can trust to be open, honest, and transparent throughout the entirety of the deal.

Business plan execution phase

As the business plan is being executed and necessary renovations are taking place, you will receive regular updates about those changes. Every multifamily syndication is slightly different as it relates to payouts and distributions during this time. Some syndication deals offer payouts throughout the length of the deal (usually monthly or quarterly,) while others don’t pay out anything until the end of the deal when you receive a lump sum. You will know what to expect in the way of payouts prior to your initial investment.

Be mindful when choosing a syndicator making sure that they are clear and upfront about what you can expect, how the deal will operate, when distributions will be paid, the intended budget, and so on. If there are any pauses in construction or changes to the plan, all of that information should be provided to you.

You will also receive a K-1 tax form, which you will be responsible for filing as part of your annual taxes. These forms will come once per year for the length of the deal.

Sale of the property phase

As the project comes to an end, the syndicator will communicate with all passive investors about the upcoming sale of the building. This happens once the business plan has been executed and targeted returns have been reached. You should get a notification approximately 90 days ahead of the sale so you can begin to prepare for your next move.

During this time, you can begin making arrangements with your tax advisor to discuss the implications of the payout you are about to receive. You will also need time to decide what you will do with the funds once they are allocated to you. Many investors choose to roll the profits into the next deal in order to further grow their equity and limit their tax burden. If this option is available, your syndicator should provide you with all of the details. Once the property is sold, you will receive a final payout of profits plus your principal investment back, less any previously agreed-upon fees.

That’s it!

You’ve successfully gone full cycle on a passive real estate investment. The more you understand projects of this scope from all angles, the more comfortable and confident you will be in your investment ventures. When looking to invest in a syndication, it’s of the utmost importance that you choose a syndicator that you can trust.

Transparency, communication, and professionalism are the name of the game when it comes to real estate investing. Then it just comes down to preparation and patience. Remember, you’re in this for the long run - sit back and enjoy the cash flow ride!