How to Evaluate Your Returns in a Real Estate Syndication

It’s no secret that real estate investing has an endless list of benefits, including regular cash flow, equity growth, and tax benefits, just to name a few. There’s a reason why so many people of all ages, backgrounds, and income brackets choose to invest their money in real estate as a means of growing their wealth.

When it comes to multifamily apartment syndications, several different deal structures and investment paths are available to you. Understanding these strategies and their associated terms will help you make better investment decisions if you choose to invest in this asset class.

As a passive investor, while you’re not completing the day-to-day management of the project, it is helpful to understand how certain things are calculated, what returns you can expect, how depreciation affects your bottom line, and the investment options available to you. In this article, we will go over common terminology and concepts at a high level that are foundational to guiding your investment decisions.

If you want to dive deeper into the definitions, calculations, and terminology of specific to returns such as IRR, ROI, AAR, and COC, you can review that information in this comprehensive article.

Multifamily investment classes

As you start to receive opportunities to invest in multifamily syndications, you will notice that there are oftentimes multiple investment classes to choose from. Which investment class you choose will depend on what’s important to you, such as receiving regular income, known as cash flow, or building your wealth.

The options include straight annual returns, where you get paid a specific percentage amount each year based on your initial investment and equity growth, where you collect smaller payments throughout the deal and a large payment at the end. Typically you can also invest in multiple asset classes if you want a balance of both

Let’s dive into the what’s what of each.

Preferred Return Investment Class

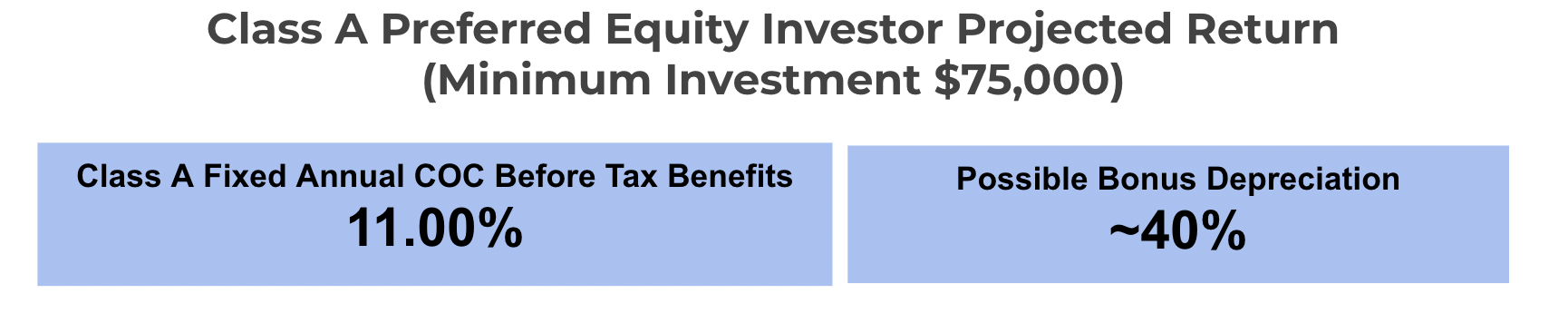

Preferred returns are typically a fixed percentage return on their principal investment (i.e., 11%) paid annually. These investors are at the front of the line when payments are distributed. Those who choose this investment class are paid first before equity investors receive their cash flow. Because of this payment hierarchy, while nothing is guaranteed in real estate, preferred returns are considered less “risky” than other strategies.

Example of a projected preferred return investor return in a syndication offering

It’s important to note that preferred investors are not lenders. They still own a portion of the property, qualify for the same tax benefits as other investors, and collect a piece of the profit at the end of the deal.

On some occasions, the syndicator is unable to pay distributions right away. This can happen during renovation periods when expenses are unusually high or at the beginning of the investment when operations are normalizing. If this scenario arises, the funds are accrued and rolled over into the following payout period. When the next payout period rolls around and payouts are resumed, the preferred returns investor will receive a cumulative return, including missed payments and whatever is due for the current pay period. As a passive investor, make it a point to ask the syndicator if returns are cumulative and what happens if a payment is missed.

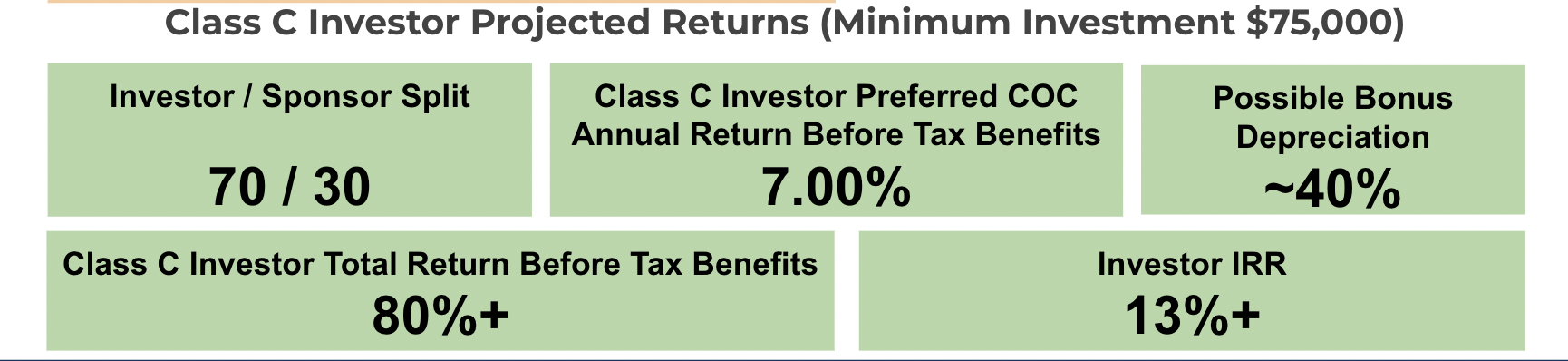

Equity Returns and the Investor/Sponsor Split

Investing for equity is slightly riskier than the preferred returns class in the sense that those who invest for equity are not guaranteed cash flow throughout the project, and if they do receive cash flow, it comes after preferred return investors are paid out; however, with the higher risk comes a higher reward. When you invest as an equity partner, you participate in what is called the investor/sponsor split. This happens at the end of the deal after the sale of the asset. Once the syndication team finishes paying off the loan, selling costs, and preferred returns, the remaining profit is distributed to the rest of the investors, including general partners and limited partners.

The distribution of the money depends on the agreed-upon split and how much money you put into the deal as a passive investor. Typical splits you may see would be 75/25 or 70/30.

Example of an equity investor projections in a syndication offering

Let’s use 75/25 for this example.

75% of the profits will be distributed to the passive investors (aka limited partners), and 25% will go to the sponsors (aka general partners). Remember, the sponsors do the hard day-to-day work, so you don’t have to!

How much of that 75% goes into your pocket depends on your initial investment, which determines your percentage of ownership. If your shares show that you own 5% of the property, you will receive 5% of the 75% profit. You can find your ownership percentage on the SREO document provided to you at the beginning of the deal.

For example:

The profit of the sale is $1,000,000

25% of that is $250,000, which goes to the sponsors/syndication team

75% of the profit is $750,000, which is split between investors

If your ownership is 5%, you will receive $37,500 (5% of $750,000)

Participation in the profit split only happens for those who invest for equity growth. If you invest solely for a straight return, then this split does not apply to you upon the sale of the asset.

One thing to keep in mind when evaluating opportunities and potential sponsors is whether or not the sponsoring team has their own money in the deal. Having their money involved gives them the motivation to execute the business plan with the utmost efficiency and make as much profit as possible, giving you reassurance and a feeling of security in your investment.

Explaining Returns in Multifamily Real Estate Syndications

Now that you understand the different investment classes and how they impact your share of profits, let’s look at terminology commonly used in investment offerings to calculate returns. Two of the most common calculations and terms are total returns and IRR. In short, total return is an easy way to calculate your expected profit over the course of the deal, while IRR is a way to measure how hard your money is working for you annually compared to other investments you could be making, like stocks. .

Total Return (ROI)

According to Investopedia, Total Return is the actual rate of return of an investment or a pool of investments over a given evaluation period based on the market performance.

A syndicator will show you the projected total return over the life of the deal according to your chosen investment class. A projected total return is the amount of profit you can expect after a period of time. This number factors in price appreciation and income generation during the life of the deal and includes the total of any cash-on-cash returns.

Total returns are expressed as a percentage.

For example:

The projected total return is 90%.

You invest $100,000 into the deal.

You can expect a $90,000 profit over the life of the deal, plus your principal investment of $100,000 back.

Internal Rate of Return (IRR)

IRR is expressed as an annual percentage return, whereas total return takes into account the return over the total lifetime of the deal. This is the preferred measurement when it comes to examining investment opportunities, as IRR takes inflation, time, cash flow, and opportunity cost into consideration. In the example above, if the deal was a 5-year project, the average annual return (AAR) would be 18% (90% / 5 years). But the IRR might come out to 15% because it takes into account other factors not included in the AAR.

Questions to ask when evaluating a potential deal include how the syndicator calculated the IRR and what their average IRR has been on other projects in that asset class.

Learn about the difference between AAR and IRR in our prior blog article. You can also calculate the expected annual IRR of any investment, including a real estate syndication, using our IRR calculator.

Depreciation in Real Estate

Real estate investing is slightly different from other investments in that the physical nature of it results in inevitable depreciation over time. Unlike stocks, notes, and land, an apartment building’s parts are considered to lose value over time, making it one of the most powerful investment tools to capitalize on tax benefits. According to the IRS, depreciation is considered a loss on paper that can shelter your passive gains.

Every part of a building depreciates over time. This can be calculated based on a standard formula provided by the IRS or accelerated if what is called a cost segregation study is done. This study essentially allows an engineer to break down the components of the building into its parts and depreciate them at different timelines. It benefits real estate investors because it allows them to take these losses at a faster rate and potentially reduce their tax burden by offsetting the gains of the investment.

How much depreciation will impact your tax bill will depend on your personal tax situation. As with all investments, it is important to consult your CPA to understand how a passive real estate investment might affect your overall tax obligation. A CPA who has an understanding of passive real estate investing can help you figure out how to best capitalize on depreciation and the tax benefits associated with real estate by building a comprehensive strategy for when you invest and how much.

The more you understand these foundational concepts of multifamily syndications, the more you can make well-informed decisions as a passive investor. Which investment class you choose and the projected returns of a deal will be large factors in deciding which opportunities you invest in, so be sure to ask plenty of questions when vetting potential sponsors and deals.

Don’t be afraid to ask for more information about any particular topic, and always consult your CPA about any investment decisions and their potential repercussions. Keep in mind that when you are vetting a deal, the syndicator should be able to outline all of these numbers and calculations for you.